Amit Sharma, Senior Manager – Research, Industry Intelligence Practice, CMR

There has been a significant growth in 5G smartphone shipments in the Indian market.

In just three years, 5G smartphone shipments have exceeded the impressive milestone of 100 million units. Comparatively, 3G technology took around 6-6.5 years, and 4G took approximately 3 years to reach the same 100 million mark.

This growth in 5G shipments is driven by the rapid expansion of 5G networks, increasing consumer awareness about the benefits of 5G, and the availability of affordable 5G smartphone options. These factors have collectively contributed to the strong demand for 5G smartphones in India, making it a key growth segment in the India mobile handset market.

The rising 5G momentum

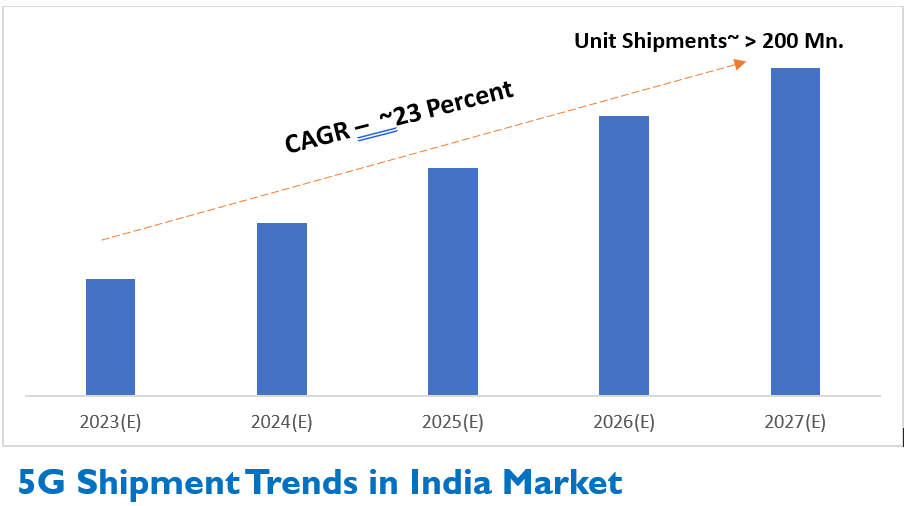

The market for 5G smartphones in India is expected to grow at a compound annual growth rate (CAGR) of around 23% until 2027. In 2027, a majority of the smartphones shipped will be 5G phones.

The co-existence of 2G/4G Feature Phone Market

Indeed, despite the rapid growth of 5G smartphones, the coexistence of the 2G and 4G feature phone markets is expected to continue for the foreseeable future. Feature phones, including both 2G and 4G variants, are more affordable and offer a simpler user interface, making them easier to navigate for individuals who are not as tech-savvy or prefer a more straightforward device. These feature phones cater to bottom-of-the-pyramid consumers who prioritize basic communication needs and do not require advanced smartphone functionalities. The affordability factor plays a significant role in ensuring that feature phones maintain their market presence, as they continue to serve a specific segment of the population that seeks cost-effective and user-friendly communication devices.

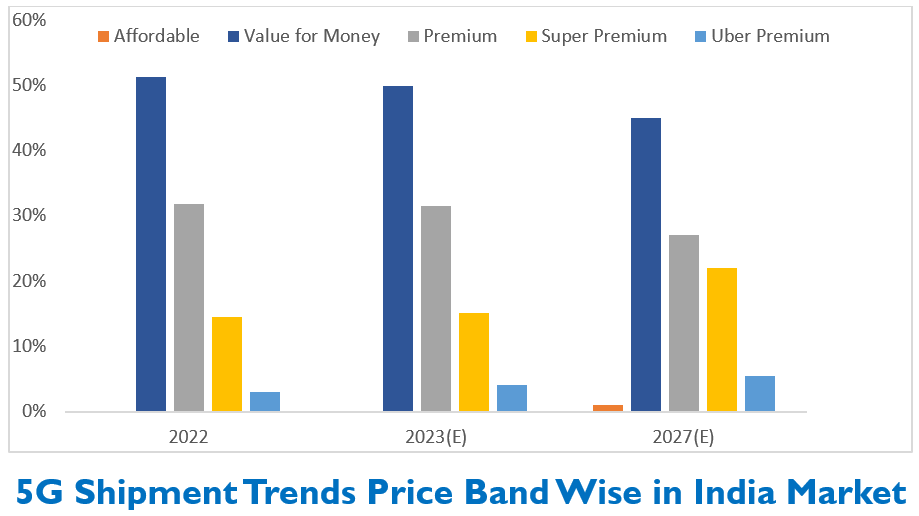

At CMR, we anticipate an increase in the market share of Super Premium (INR 50,000 – INR 1,00,000) and Uber Premium smartphones (>INR 1,00,000) by around 8-9% and 2-3% respectively in 2027 compared to 2022. This growth is driven by the strong demand from consumers who prioritize advanced technologies in their smartphones. These advanced technologies, including faster speeds, reduced latency, enhanced connectivity, improved streaming experiences, and access to innovative applications, are key factors that attract consumers to the Super Premium and Uber Premium segments.

With the rapid momentum of 5G technology, we expect to see a gradual decline in the shipments of 4G phones in the coming years. The shift towards 5G smartphones can be attributed to the additional advanced features that these devices offer, such as improved camera capabilities, higher refresh rate displays, and better battery management. These technological advancements provide users with a superior overall smartphone experience, leading to a decrease in the demand for 4G smartphones. Overall, the increasing adoption of advanced technologies and the growing popularity of 5G smartphones are driving the market towards the Super Premium and Uber Premium segments, resulting in a decline in the shipments of 4G phones.

The 5G Diffusion

We expect a continued momentum for 5G smartphones, particularly in the mid to lower price tiers and anticipate that in early 2024, 5G smartphones will be introduced in the sub-10k price range, making them more accessible to a wider consumer base. Key challenge in democratizing 5G technology further lies in striking a delicate trade-off between the chips and other specifications of the devices. CMR forecasts that the majority of 5G shipments in 2023-24 will fall within the INR 15-35k price range. As the momentum for 5G technology grows, there is an anticipated gradual slowdown in the shipments of 4G smartphones in the coming years, reflecting the shift towards the advanced capabilities and features offered by 5G devices.