CY2017: Slow Paced Year for India Consumer Storage Flash Memory Market

Share This Post

The India Consumer Storage Flash Memory Market CY2017 ended with a low note. It was an impeccable example of path full of crest and trough. Alternate rise and fall of the market was the key trend observed throughout the year. The market witnessed 38% decline as against CY2016, in terms of units shipped.

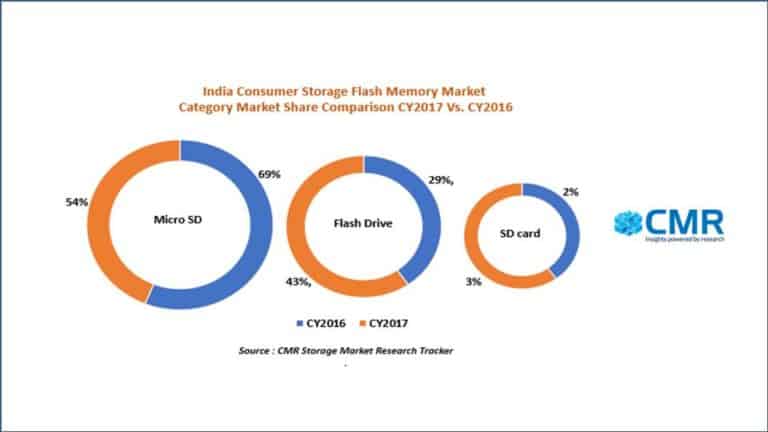

Despite being the forerunner and the leading contributor, Micro SD cards category didn’t contribute much to the India Consumer Storage Flash Market in CY2017. Growth of 16GB internal memory smartphones in the overall mobile handsets market catalyzed the drop in Micro SD card sales. Micro SD card shipments witnessed phenomenal 52% decline in CY2017 when compared to CY2016.

However, around 840 PB (Petabytes) memory were added to the overall Consumer Storage Flash Market by Micro SD, Flash Drive and SD card categories collectively.

Easy download and access of heavy documents in the mobile due to large and expandable internal storage has led to Flash drive market downfall. Flash Drive cards market witnessed 7% decline in CY2017 respectively when compared to CY2016 in terms of units shipped.

Smartphones with high pixel cameras capturing superb quality photos influenced the camera sales and in turn resulted in SD cards market sequential decline of 8% in CY2017 in terms of units shipped. However, marriage season acted as the stimulant for the huge growth of this category in 1Q CY2017 and 4Q CY2017.

Overcoming the demonetization effect, Consumer Storage Flash Memory Market shipments revived with 5% sequential growth in 1Q CY2017. However, in 2Q CY2017 shipments witnessed a sequential decline of 8% as a result of the air of confusion around GST. Festive season loaded with lucrative offers arrived as a fresh breeze and restored the overall market shipments with 33% increase in 3Q CY2017.As expected, 4Q CY2017 witnessed sequential decline by 17% in shipments due to the end of the festive season.

Major Players

- SanDisk, the Californian manufacturer of Flash Memory Storage Solutions, continued to rule the market in all the three categories. SanDisk’s Pen Drive model Cruzer Blade (SDCZ50) 16GB topped the flash drive models chart.

- Strontium, based out of Singapore, is another major PC and flash memory manufacturer. It had a phenomenal growth in CY2017 replacing Samsung to be on the second spot. Strontium has contributed majorly to the Micro SD and Flash Drive categories.SD cards are of not much interest to the manufacturer.

- The Japanese multinational Sony Corporation captured the third spot. Sony largely contributed towards the Flash Drive and SD card categories. Sony’s USM16 16GB was one of the top ten pen drive models.

Samsung and Transcend shipments witnessed continuous downfall in CY2017 when compared to CY2016.

Capacity Movement

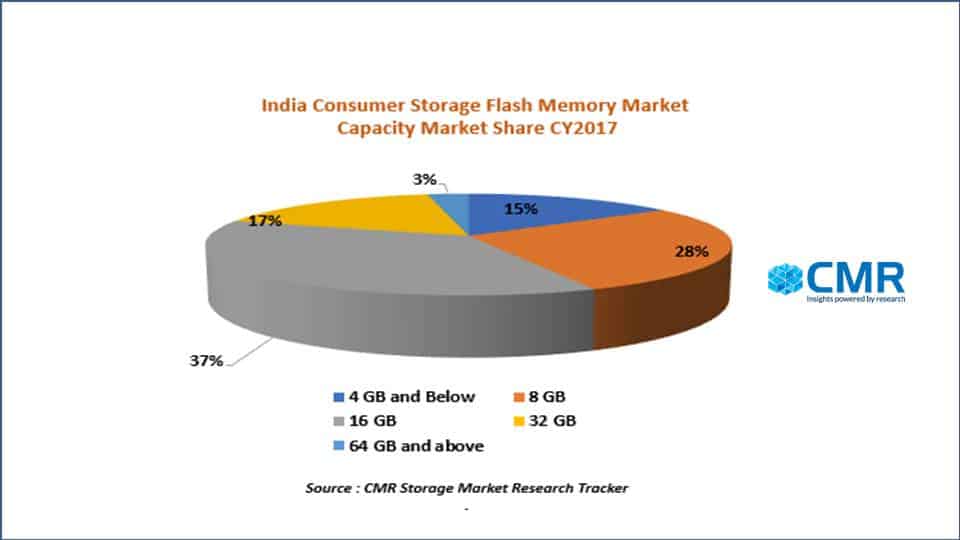

Overall Consumer Storage Flash Memory market in CY2017 saw movement towards 32 GB capacity segment. Market share of this capacity segment increased from 11% in CY2016 to 17% in CY 2017. Market share of 64 GB segment also witnessed sequential growth in terms of unit shipments.

However, 16 GB capacity segment was the largest contributor in CY2017 in terms of units shipped.

Future Outlook

Irrespective of the continuous launch of large memory mobile phones under different price bands, consumption of memory space by android, apps for various entertainment activities, downloading heavy videos etc, will further drive the growth of Micro SD cards market in coming quarters. Pen Drive sales will also increase in 1Q CY2018 as nowadays photographers choose pen drive over compact disk (CD) to provide the heavy wedding videos. Demand for dual Pen Drives providing hassle free data transfer between mobile and laptop at one go will rise. SD card sales will continue to grow in 1Q CY2018 because of the peak marriage season.

Going forward the market will continue to shift towards higher capacity segments on account of implementation of 3D Flash Technology by the major vendors in their manufacturing process. 3D Technology developed by flash manufacturers is aimed to achieve higher densities at a low cost per bit.

Gradually, Micro SD cards will be marked with A1 marking/symbol. This specifies them to be fast enough to be used to start heavy apps and programs. SanDisk’s A1 marked Micro SD cards are already available in the market and Strontium is all set to launch the same in April 2018.