Samsung reaffirms leadership position in the India Mobile handsets market in 2Q CY 2015, registers 19% shipments growth quarter-on-quarter

Share This Post

Smartphones on way to account for half of all mobiles phones shipped in India; ‘crossover’ expected by September 2015

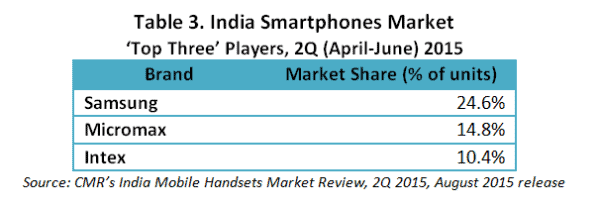

- Despite maintaining leadership positions, Samsung and Micromax lose market share in the India Smartphones segment

- Smartphones currently add up to 43% of total India mobile phone shipments, register over 25% quarter-on-quarter growth

- India Manufacturing share up by 5% to touch 24.8% of total units shipped in 2Q CY 2015

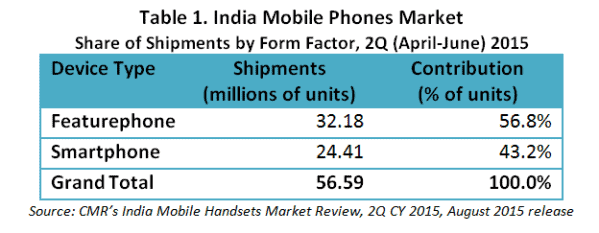

New Delhi/Gurgaon: As per CMR’s India Mobile Handsets Market Review, 2Q CY 2015, August 2015 release, the country shipped a total of 56.6 million handsets during the April-June, 2015 quarter with 43% being Smartphones. The overall market grew 7% quarter-on-quarter (QoQ), while Smartphones alone grew at 24.8% in shipment terms during the period.

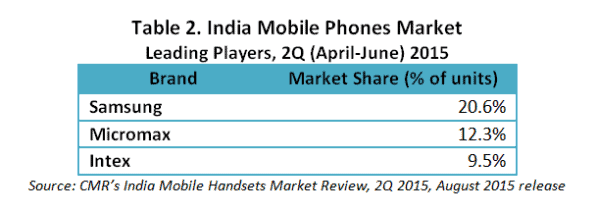

Samsung continued to lead the market with a 20.6% share of overall mobile handsets shipped, while for Smartphones the company’s share was 24.6%. The South Korean player was followed by Micromax and Intex in terms of overall shipments of mobile phones as well as in the Smartphone category.

Explaining the implications, Faisal Kawoosa, Lead Analyst, Telecoms Practice, CMR, said, “While Samsung’s share continues to be ahead of its nearest competitor, there could be some advances at second and third spot, primarily affecting Micromax if it does not devise and implement a more robust marketing strategy to grow its shipments. ‘Me too’ strategies such as attempts to imitate niche Chinese players haven’t worked very well in favour of Micromax in the past – be it flash online sales, or other move.”

Karn Chauhan, Analyst, CMR’s India Telecoms Practice cautioning players about their go-to-market strategy opined, “The online sales route is an essential component of any vendors’ strategy, but, it should not be at the cost of expanding offline reach. Players like Intex have believed in reaching out to first time Smartphone users, and this strategy has paid off very well for them, giving them entry into the “Top 3’s list.”

Smartphone shipments continue to increase as a proportion of the total mobile handsets shipped in India. During 2Q (April-June) 2015, smartphones accounted for 43.1% of total mobile phones shipped, up from 36.8% in the previous quarter. Expecting a similar growth momentum in the India market during the 3Q (July-September) 2015, Smartphones are expected to notch up half of total mobile phone shipments by September 2015.

Impact of ‘Make in India’

The ‘Make in India’ campaign has had a positive impact on mobile handsets manufacturing in the country. Of the total handsets shipped in 2Q CY 2015, 24.8% were manufactured and/or assembled in India compared to 19.9% in the previous quarter (1Q CY 2015).

While this is a positive development, the growing concern here is the strong position enjoyed by China brands (China OEMs and brands) in the Smartphones category. The contribution of Chinese brands grew 97% year-on-year (YoY) during 2Q CY 2015 as against 48% for Indian brands within the Smartphones segment. Such influence and acceptance of Chinese brands poses a challenge to emerging as well as incumbent Indian brands of smartphones.

Expressing his concern, Faisal Kawoosa, Lead Analyst, CMR Telecoms Practice suggested, “Although domestic manufacturing of mobile phones has increased, the government must introduce minimum value addition norms for mobile handsets as a threshold for qualifying to be labelled as ‘Made in India’. This will push the industry to devise ways and techniques to increase the value of domestic contribution across the value chain.”

Share This Post

CyberMedia Research conducts the Budget Smartphones Channel Audit to capture the perspectives, preferences, challenges and dislikes of retailers around ‘value for money’ (INR <10,000) smartphone brands, capturing a compelling picture of smartphone brands in the market.

CMR offers industry intelligence, consulting and marketing services, including but not limited to market tracking, market sizing, stakeholder satisfaction, analytics and opportunity assessment studies.

Its bouquet of consulting services includes incubation advisory, go-to-market services, market mapping and scenario assessment services. CMR is servicing domestic as well as international clientele in India and few global destinations. The clientele serviced represents SMBs, Large Enterprises, Associations and Government. CMR’s core value proposition encompasses a rich portfolio of syndicated reports and custom research capabilities across multiple industries, markets and geographies. For details on the survey findings, ping Satya Sundar Mohanty at smohanty@cmrindia.com, or call +919821690824.

A part of CyberMedia, South Asia’s largest specialty media and media services group, CyberMedia Research (CMR) has been a front-runner in market research, consulting and advisory services since 1986. CMR is an institutional member of Market Research Society of India (MRSI).

More To Explore

No posts found!