Nvidia Corporation’s recent financial results have once again surpassed expectations, solidifying its position as the most valuable chipmaker in the world. The company’s shares soared following the announcement of an impressive revenue forecast of $24 billion for the current quarter, exceeding analysts’ predictions of $21.9 billion. This performance continues Nvidia’s trend of exceeding market expectations, driven by the soaring demand for its artificial intelligence (AI) accelerators.

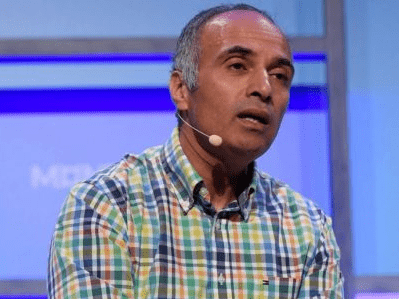

These advanced chips are at the forefront of the AI revolution, powering various generative AI applications, from chatbots to content creation tools. Nvidia’s CEO, Jensen Huang, emphasised that “accelerated computing and generative AI have hit the tipping point,” with demand surging globally across various sectors.

The market has responded enthusiastically to Nvidia’s success, with the company’s valuation reaching a staggering $1.7 trillion, an increase of over $400 billion this year alone. This growth is a testament to the market’s confidence in Nvidia’s pivotal role in the ongoing AI computing boom.

The ripple effects of Nvidia’s performance were felt across the semiconductor industry, with shares of other chipmakers like AMD, Broadcom, and Marvell Technology also experiencing gains. This collective market movement underscores the industry-wide anticipation surrounding Nvidia’s report and the broader implications for AI technology’s growth.

Nvidia’s latest financials reveal a tripling of revenue to $22.1 billion in the fiscal fourth quarter, with its data centre division, now the most significant revenue source, generating $18.4 billion, a 409% increase from the previous year. The company’s dominance in the AI space is further highlighted by its significant customer base, including tech giants like Amazon, Meta, Microsoft, and Google, which account for nearly 40% of Nvidia’s revenue.

Looking ahead, Huang predicts a new investment cycle in generative AI, projecting a doubling of the world’s data centre installed base over the next five years. This expansion represents an annual market opportunity in the hundreds of billions, signalling a transformative period for AI computing.

However, Nvidia faces challenges, including increased competition and the push by some customers to develop their own AI chips. AMD has entered the fray with its MI300 accelerators, anticipating revenues of $3.5 billion this year, a significant increase from its initial $2 billion forecast.

Despite these challenges, Nvidia remains proactive, with experts predicting the release of even more potent accelerators to maintain its competitive edge. Additionally, the company is adapting to new export regulations for its chips destined for China, the world’s largest semiconductor market. To comply with these rules and continue its operations in this crucial market, Nvidia has strategically scaled down the capabilities of its products.

Nvidia’s strategic partnerships, such as the recent deal with Cisco Systems to distribute AI systems, further demonstrate its commitment to maintaining its leadership position in AI computing.

In summary, Nvidia’s remarkable performance and optimistic outlook underscore the company’s central role in the AI-driven technological revolution. As the industry continues to evolve, Nvidia’s innovations and strategic moves will be crucial in shaping the future of AI computing.