In Gujarat and Tamil Nadu, the merged entity, ViPo would become #1 and in Maharashtra, Punjab and Gujarat, it would have market share above the respective adjusted #1 player in these states.

In a recent viewpoint we had suggested few meaningful mergers and acquisitions for the handset industry including the merger of Vivo and Oppo as one strong entity.

The reasons to advocate this were very simple but important as both brands have more or less same target group, product portfolio and strengths like presence in offline market and backed by the same BBK Group.

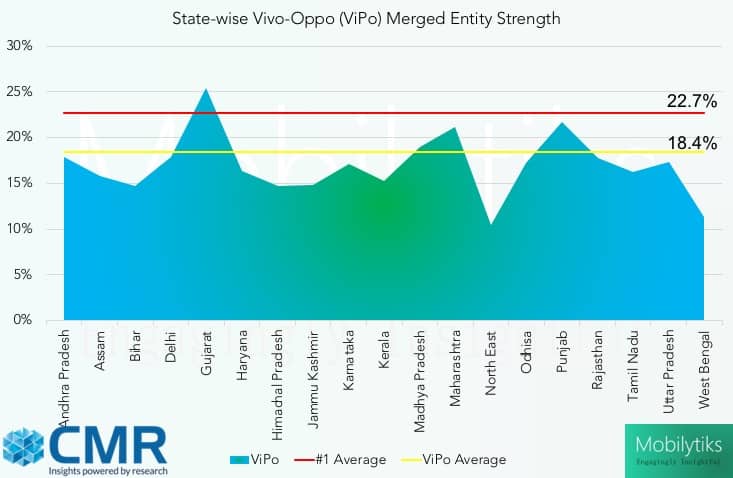

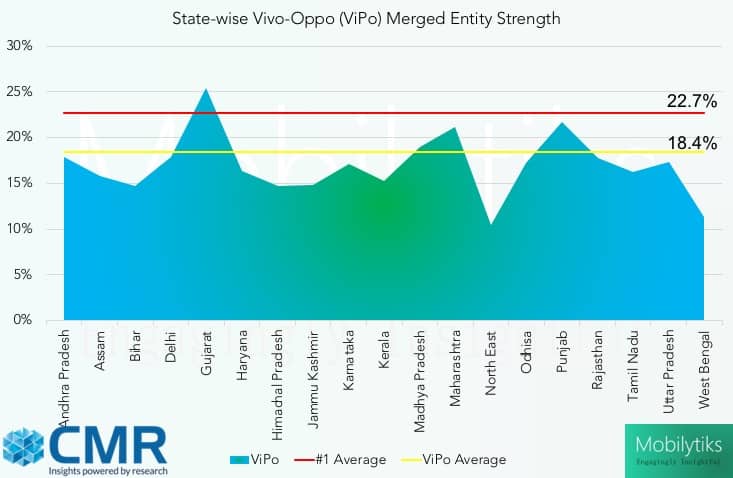

To further strengthen the proposition, Mobilytiks has compelling reason for the BBK management considering the merger of Vivo and Oppo. The adjusted average of #1 brand in Smartphones across the states of India is 22.7%. Vivo and Oppo have never crossed 10% market share at any point of time. In some states, though, either of the two, Vivo or Oppo, has seen market share in the range of 10-12% in any quarter. However, if the brands are merged, the adjusted average market share would just shoot up to 18.4%. This would not only make the merged entity #2 across most of the states in India, but also result in a very strong #2 in the industry. That would open up a third entity in the market as the primary competition is between Samsung and Xiaomi across the states in India.

In Gujarat and Tamil Nadu, the merged entity, ViPo would become #1 and in Maharashtra, Punjab and Gujarat, it would have market share above the respective adjusted #1 player in these states.

The merger recommendation is not just because the data is suggesting that. Of course, decisions of the present time are data driven; but, it is almost strategically inevitable for the two brands to subsume in one strong entity. That would give them all the requisite resources at desired levels to compete the rising competition and focus in the offline space which could disrupt and displace them from the strong market standings they enjoy at the moment.

There are other brands also due for inorganic growth strategies. However, Vivo-Oppo makes the perfect case that would also encourage others in the industry to take bold strategic steps to resurrect. As the market opportunity squeezes in the Rs 10-20,000 price segment, due to primary focus on entry level Smartphones, room for manoeuvrability for brands like Vivo and Oppo is contracting and they need to emerge with strengths and not just ‘steroids’ that may charge them momentarily.

Thus kickstarting the era of M&As in Indian Handset industry.