CyberMedia Research regularly conducts the Mobile Industry Consumer Insight (MICI) Survey to capture the consumer aspirations, preferences and challenges, and dislikes around smartphone brands. These large-format surveys provide a compelling picture of the changing dynamics of the Indian Smartphone Market.

The latest edition of the MICI focused on premium smartphones, with a clear intent to capture consumer perspectives on the key factors that they consider in a smartphone, while upgrading. In addition, the study aimed at understanding the most preferred smartphone for quality of service, and after sales. Lastly, the study focused on determining the brand imagery associated by consumers with their smartphone brands.

While marquee smartphone brands, like Apple and Samsung continue to dominate the India smartphone market, the real story emerges when one looks beyond them at the slew of young smartphone brands which are making a dent, and capturing a healthy mindshare amongst Indian smartphone consumers. For instance, the latest CMR MICI findings establish that OnePlus is scoring high on various parameters, commanding a very high loyalty amongst its users, emerging as a desirable brand with a high resale value. Even though the OnePlus brand has evolved over a period of time, its customers continue to remain loyal to it.

Here is a snapshot of the major findings from the latest MICI:

- Type of Premium Smartphone Customers

The premium smartphone segment comprises of three distinct type of customers:

Explorers: 34% of the customers who follow technology trends very closely and are always among the first to adopt the latest technology.

Followers: 24% of the customers who are keen to purchase new smartphones, provided its already popular among other people.

Passive Viewers: 42% of the customers are passive, who just follow technology trends, rather than purchasing the latest technology before most people.

- Key Factors Considered for Smartphone Purchase

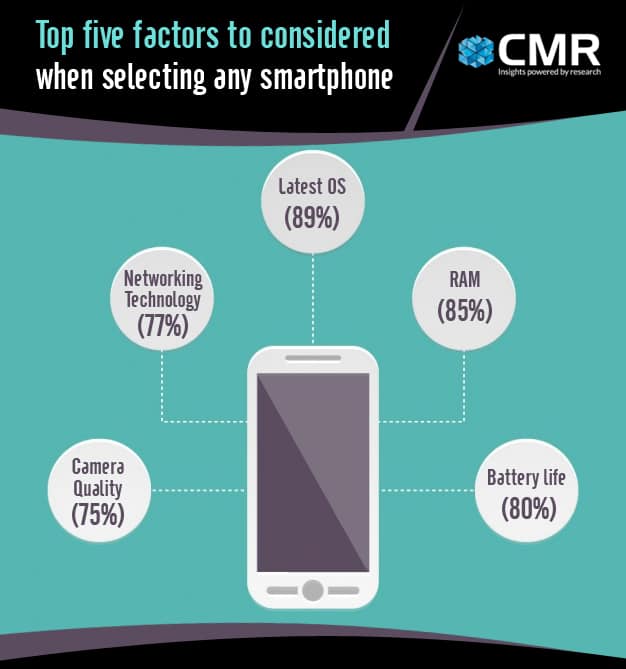

As per the CMR MICI Survey findings, consumers look for many different attributes in a smartphone brand before making a purchase. Among others, it includes the latest OS, RAM, battery life, networking technology and camera quality.

- Smartphone Buying Behavior: Online Buyers likely to increase

Around one-fourth of the users have bought their smartphone online. As per the MICI findings, there is likely to be 17% increase in the number of online buyers in future.

Triggers for buying online include the attractive discounts and schemes (93%), followed by the variety of products and brand choices available (90%). As per the MICI findings, one of the main barriers for consumers not going for online purchase include the inability to ‘touch and feel’ (87%), and ‘the lack of immediate gratification’ (80%).

- Preferred Brand for Smartphone Upgrade

The preferred smartphone brand for future purchase continues to be Apple. Amongst Apple users, the MICI survey findings reaffirm that current Apple users have the maximum brand loyalty.

- Brand Imagery associated with Premium Smartphones

The smartphone has moved beyond being a simple communication tool, and is perceived by consumers as a natural extension of their lifestyle. Today’s pioneers, followers and even passive viewers, go beyond product reviews and deliberations around not just product features, but consider the smartphone connect with the lifestyle, akin to a lifestyle category product. The statement is a reflection of the MICI survey research findings.

- Highest Recommended Smartphone Brand Indian premium smartphone consumers are highly discerning. For a smartphone brand, highly satisfied customers are key, as only such customers would translate into loyal ambassadors for the smartphone.

OnePlus is ranked first with customers regarding it as the “highest recommended brand”.

- Trust and Desirability

Consumers repose trust and desirability on smartphones based on their previous association with a brand, or on their affinity based on brand visibility. Among premium smartphones, HTC ranks first, followed by OnePlus at second position when it comes to “trust and desirability”.

- Most Innovative Brand

New technological innovations always excite the discerning Indian customer. Google is regarded as having the “highest level of innovation”.

- Smartphone Brand Visibility: The maximum recall is observed for Oppo across almost all the media platforms.

- Resale Value: When it comes to “resale value”, the OnePlus brand scores the highest, ranking first, amongst consumers.

- Brand Satisfaction Amongst OnePlus customers, the brand has got the highest satisfaction scores in terms of:

- Quality of the Phone: 100% of OnePlus customers are satisfied.

- Availability of Spare Parts: 96% of the OnePlus customers are satisfied with availability of the spare parts.

- Speed of Problem Resolution: 90% of the OnePlus customers are satisfied with problem resolution.

- Usage Patterns for Premium Smartphones

Smartphone users perform a variety of activities on their smartphone. Topping the list is Social networking (98%), followed by listening to music (88%), watching video (83%), gaming (74%), and, taking photos (68%). Beyond entertainment, smartphone is used for net banking (40%), online shopping (29%), and in navigating traffic (34%).