Nokia is making a comeback in Indian smartphone market this year. This will be emergence of Nokia as a smartphone for the second time, as the first one to account was an ‘affair with Microsoft’ that resulted in Lumia series. Asha series of Nokia was not a smartphone category; rather Nokia had attempted to create a ‘Smart FeaturePhone’ category through it.

This time, thanks to well thought out product strategy of HMD Global, we are going to experience some good Nokia smartphones out there for consumers.

Will Nokia be able to take a bite out of LOVE brands’ market share?

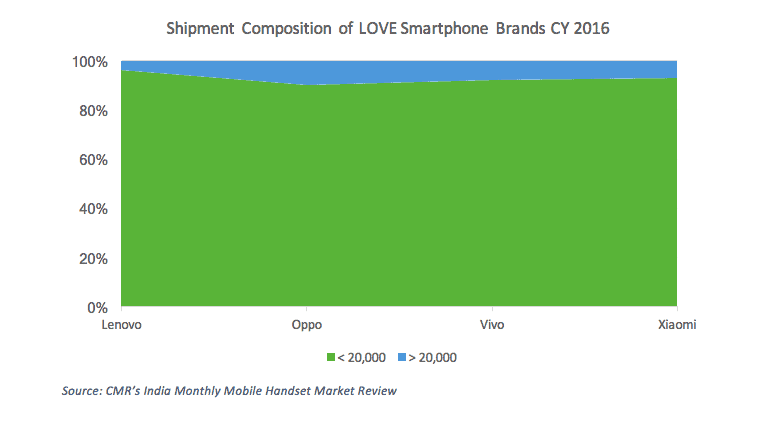

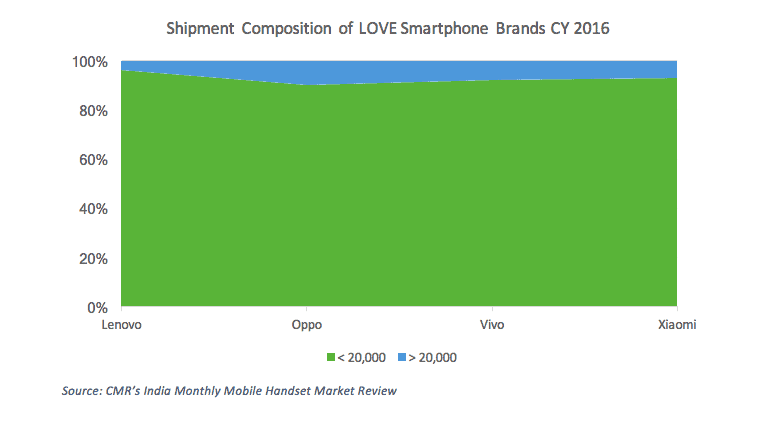

As per my assessment these smartphones are going to be in the range of Rs 7,000-20,000 mainly, which means that Nokia will be present in ‘Affordable’ and ‘Value for Money’ smartphone categories. This is going to a situation that LOVE brands of smartphones – Lenovo, Oppo, Vivo and Xiaomi should be wary of. With smartphones portfolio of Nokia, LOVE brands must expect a disruption in the market and if very well executed, they should see a direct impact on their market shares, as over 90pc of LOVE brands sales (volume-wise) at present comes from the smartphones that are priced less than Rs 20,000.

Agreed that Nokia is now in a startup mode and the LOVE brands have integrated very well with the users, especially the youngsters that drive more than 90pc of the smartphone sales in the country. But, Nokia has its own ‘stature’ if I may say so and that is going to be an important strength with which they will mark the innings.

But they cannot rely on this legacy alone- it must be matched by compelling propositions that anyone would be expecting from Nokia.

Challenges that Nokia is likely to face:

For Nokia, the biggest challenge would be to match the marketing and advertising spends of LOVE brands and be able to create enough noise within the crowd out there. And this connect should be with youth, for whom Nokia was an underperforming smartphone brand as Lumia and after a rejig is attempting to emerge again on the arena. At this juncture, I don’t have a sense of whether Nokia would be having deep pockets like Oppos and Vivos of the world to splurge on aggressive marketing and advertising strategies. But irrespective of the scale of their budgets, the return on their marketing spends should be at least commensurate.

The fundamental building block of Nokia, as I understood is going to be keeping it simple while infusing the Nokia confidence back in smartphone users from hardware point of view. This strategy is going to reap benefits if executed effectively. I have come across several interactions with smartphone users, who were missing Nokia assurances within smartphones, especially Android ecosystem. This is exactly what it may attempt to fill in now.

I would say, Nokia has been able to bring back this confidence after experiencing some of their smartphones slated for launch soon. One could feel a sturdy Nokia handset in hands, which is fortunately smart and on Android, that runs into 90pc of the smartphones in India. With access to the channel infrastructure Nokia had in the country, I see it making a good mix of product with distribution resulting in positive outlook for the brand in the next 6-9 months.

However, it will have to do a lot of educating exercises among the potential users, who, rightly or wrongly, believe ‘more is the best’. This ‘more is the best’ positioning is what all the ‘Value for money’ brands like Xiaomi, Oppo and Vivo have been first inculcating and are now nurturing in the market. Nokia, as I could understand has a different take here. They want to give optimum to a user, that may or may not be the highest in order in terms of specifications. So while, we have 6GB and 8GB RAM smartphones in market, Nokia may not go beyond 4GB for a while. However, it will have to convince a potential average user that they need optimum and not pay for resources that may be lying unutilized and this will not be an easy task.

Will feature phones help to bring the old glory back?

Nokia is not present in smartphones only. They are continuing with feature phones in the country and this got a fillip, at least in recall and discussions, when they showcased their iconic 3310 at MWC 2017. More than 50pc of mobile phones sold in India every year are still feature phones and that it not going to change soon. Nokia 3310 has all the prospects of becoming among leading feature phone models sold in the country, pricing being the key factor. However, it should not be ignoring the significance of a 4G feature phone in the Indian market and that means it should be very quick with the launch of a VoLTE version of Nokia 3310.

Nokia, in its new avatar has been able to rise upto the expectations and even upto the discussion at board room levels. Now, it’s to be seen if they can percolate with same zeal and success right upto the last potential buyer that is somewhere out there in a very remote market of the country. That will be the litmus test of their channel and sales effectiveness.

For now, my suggestion for Nokia would be to start connecting with potential buyers aggressively and digital would be an effective way to initiate the discourse. After all, they are no longer in the bygone era of ‘Connecting People’. The challenge as well as opportunity now is ‘Connecting the Connected People’.

First published in CiOL on March 28, 2017