Does SMT mobile manufacturing make sense for all in India?

Share This Post

The biggest challenge would be of having sustainable and consistent demand to reap benefits of manufacturing by running operations at optimal levels.

Emotions apart, business is all about rationale thinking and decision making. As India ushers into CKD or Complete Knock-Down manufacturing, the initial trends and market pulse is a bag of mixed reactions.

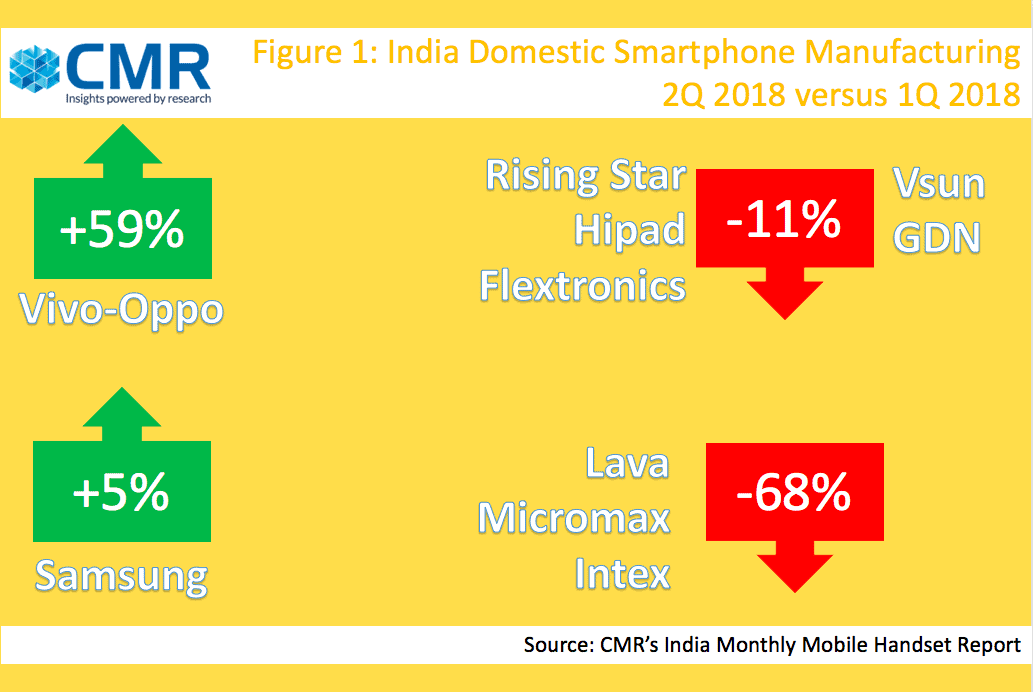

Early signs as suggested by domestic manufacturing preliminary estimates of Smartphones for 2Q (April-Jun) versus 1Q (Jan-Mar) 2018, it concludes there is a strong positive correlation between the volumes and the stability in the operations of manufacturing. This is a very basic economic fundamental and does not need to be substantiated with data.

Nevertheless, the data estimates suggest that either one has to be a very large OEM, someone like Samsung or it has to be a contract manufacturing model, wherein a third-party manufacturer produces for various brands on different assembly lines. In manufacturing, one may not achieve a straight ideal curve of volumes and fluctuations are bound to occur. However, those have to be in permissible range. Else, the unpredictability of the market affecting demand is going to cause turbulent waves in the production volumes as well. This can be seen as has happened in the case of Vivo and Oppo in positive terms and Indian brands of Lava, Micromax and Intex in the opposite direction.

Well it is now too late, as brands like Lava, Micromax and Intex have already invested in their SMT lines, but, an alternative could have been if they had collaborated by creating a common manufacturing facility. That would have served much akin to contract manufacturing model. This is where competition drives collaboration.

For SMT scale is critical to make it successful and with market becoming unpredictable as operators – incumbents as well as the challenger – are trying to align their business operations causing disruptions, demand assessment is going to be tricky for handset makers irrespective of their classification, be it Global, Chinese or Indian. There is still some scope left for brands to rejig their manufacturing strategy and align it with the market conditions. Else, they may have to go back to CBU (Complete Built Units) route importing handsets as per market movements. This may save the brands from eroding further, but definitely not a good sign for Make in india.