Why Jio will find it difficult to scale subscribers & revenue?

Share This Post

Jio from technology point of view is a disruptor in the market by bringing in not only some of the latest technologies in the country but also attempting to make data take precedence over voice.

This goes directly against the market tide where voice is still the main revenue contributor across operators. Now, there is a fundamental question that we should ask before adjudging the success or otherwise of Jio. Jio is all about data and going by what we are witnessing so far, it seems to believe that giving abundant of data at very affordable, in fact throw away prices (if we consider Rs 303 plan offering 30 GB data), is going to pull everyone on to Jio. Now lets examine if there are enough of users in the country that can make Jio successful with its business plan execution.

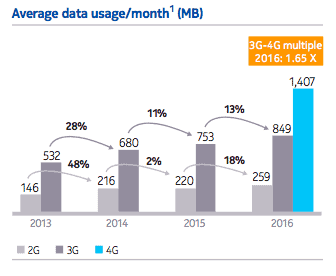

As per the latest Nokia MBiT Index 2017, there are 125 million mobile broadband subscribers in the country who are accessing Internet over smartphones over 3G and/or 4G networks. The average monthly usage of these users is 849 MB and 1.4 GB for 3G and 4G networks respectively.

Now this throws some interesting insights. As per the report, these are the users paying for a data service in the country and effectively target potential for Jio services. So, would there be enough of users within these 125 million base who would be requiring heavy data plans as offered through Jio Prime membership. The weighted average usage of high speed mobile broadband in India works out to 1.3 GB per month. Taking a substantial base of these existing paying users to a usage pattern where they would find value in subscribing to Rs 303 plan of Jio is next to impossible.

If we exclude the present ‘chaos’ period, the 3G/4G data price was averaging Rs 250 per GB and against that 30 GB for Rs 303 means paying Rs 10 per GB. This is 1/25 of the existing prices or just 4% in other interpretation. Traditionally, telephone services demand is categorized as inelastic. We can extend the same to data services as well. That being the case, we are not going to see the data consumption increasing proportionately with the decrease in price. Hence, if Jio has presumed that by bringing down the cost per GB substantially, the data consumption would equally increase, that fails the laws of economics.

Hence, the point to conclude is that the Indian data user has not arrived at a stage where we expect a lot of data consumption, especially from masses, good enough to make a business case for an operator. With all the sugar coated pricing Jio has come up with, the data usage pattern is not going to change overnight from 1.3 GB to 30 GB a month. At best, this may go to 4 to 5 GB a month.

Almost all the operators have already matched their data plans to this. While Airtel has offered 10 GB of additional data per month for 3 months, Vodafone announced 8 GB per month of freebie. This makes a subscriber indifferent to switching to Jio and hence, will stay with the existing operator for there being no economic advantage. Leave aside the service quality and bondage effect.

For an operator like Jio, which believes to make money from data only, it is important that it has a substantial base of paying users that consumes heavy data every month. To my assessment this should be at least 10 GB a month to begin with. This means, Jio should make a pay data user in India build the appetite by over 7x from the present levels. This is not an easy task. Though, they have enabled all the ecosystem by creating a mesh of apps for a user to get engaged, but the issue is changing the usage habits, and habits can’t be influenced in a jiffy.

Jio may have to wait at least towards the end of 2018, to expect a fair base of users consuming in the vicinity of what they would consider mouthwatering. For now, they have to build the business with a pinch of salt and have the patience to let the market evolve.

First published in Voice and Data on March 29, 2017