PolicyBazar: The second ‘Unicorn’ from Info Edge’s stable

Share This Post

An evolving investment model spawns another star in the InfoEdge portfolio of investments

It is both bubble-and-eye popping when we get to see not one, but two, stellar models from a technology player in today’s fiercely-competitive and fickle era.

Getting to crack one model right can, often and forgivably so, be tagged as a fluke. But what if the serendipity is repeated?

Look at Naukri.com’s parent company InfoEdge. It has been making a swathe of strategic investments in the genre of internet companies for quite some time. With Zomato already established as its first portfolio unicorn, the company is now getting traction and attention for PolicyBazaar as its second ‘unicorn’ master-stroke. Recent media and announcements indicate that InfoEdge, along with Softbank Vision Fusion (SVF), will invest close to USD 90 million in Etechaces Marketing Pvt. Limited (EMPL) for a stake of around 8.93 %. EMPL, to put this into context, provides online aggregation and marketplace for financial products through policybazaar.com and paisabazaar.com for retail consumers.

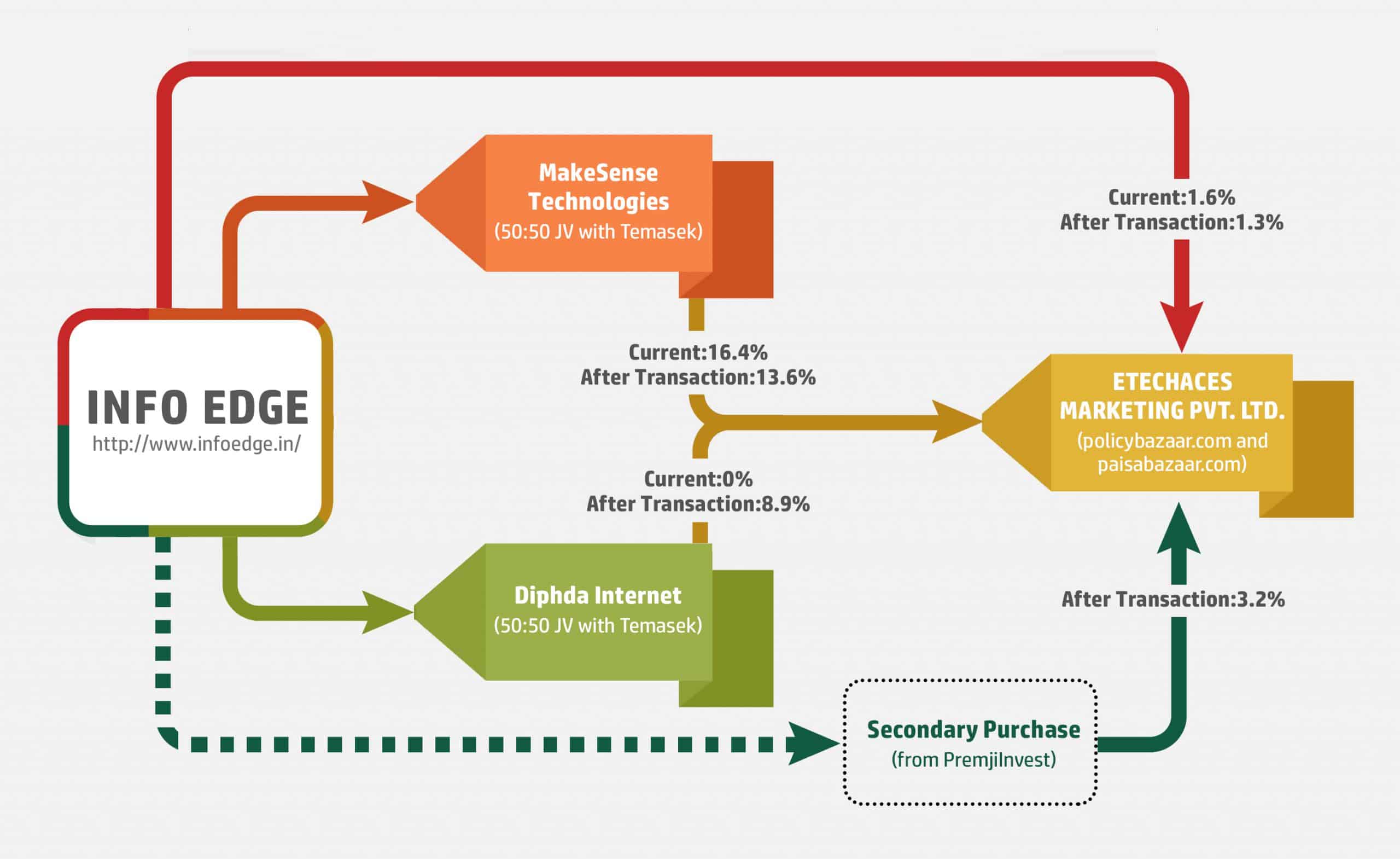

It is a part of USD 206 million of Series F funding by EMPL at an implied valuation of USD 1 billion. The post-transaction stake of InfoEdge will be close to 14% in the new unicorn PolicyBazaar. According to the agreement, both InfoEdge and SoftBank would invest an amount of about $45 million each in Diphda Internet Service for 50.01% and 49.99% stake, respectively. In turn, Diphda will invest ~$90 million in Etechaces (parent of PolicyBazaar) for 8.93% stake as shown in the infographic.The transaction also includes a direct investment of USD 105mn by SVF and the balance USD 11mn by other existing investors.

As per media reports, PolicyBazaar founder Mr. Dahiya said “Info Edge will be investing $61 million of which part will be invested for primary purposes and part for secondary purposes.” The additional investment of USD 16mn in a secondary purchase of stake could be achieved by the acquisition of stakes currently held by PremjiInvest (as depicted in the infographic above).

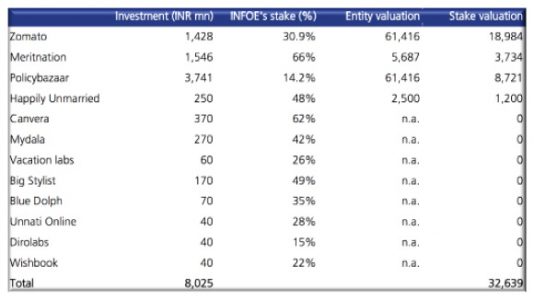

Interesting to note here now that the investment strategy of InfoEdge is impressively, and steadily, climbing a maturity curve along with other graphs. Earlier, the company had focussed its investments on seed or early-stage funding; and later, it opted for scaling down their stakes as valuations expanded either through divestment or by not participating in the later stages of funding. This has been quite evident in Zomato’s case where its holding was reduced to 30.9% (from 58% earlier). Even in EMPL’s case, it has come down to 9.8% compared to an earlier 49% stake.

Given InfoEdge’s growing cash balance as per their balance sheets, this investment deal showcases InfoEdge’s appetite to protect its stakes in late-stage funding and hunger for larger deals. The game of thrones does not always have to be a game of bones, after all.

Anyway, you never know if we may see another unicorn emerging out of its investment formula. That will change the Unicorn narrative of the industry to a large extent. And maybe, spare us from the not-so-occasional dragon-breath too.